Changes are made to ACA reporting 1095 forms each year. Comments by the IRS were released about a draft of the new 1095 C forms on July 13th 2020.

ACA reporter has also come to know that the IRS has issued its ‘final’ drafts of instructions for employers with guidelines to report regarding health coverage, which they offered employees last year (2019). Employers are now compelled according to ACA demands to ensure that the reporting forms of 1095 reach the hands of all employees.

"Employers should be ensuring they are on top of their data as the 2019 calendar year comes to a close," Arthur Tacchino advised. He further added that data systems and sources should be revised for accuracy. Small details like hiring dates should also be checked.

ALE (Applicable large employers) will have to use these forms in 2021 to prove that they followed the health coverage instructions according to the Affordable Care Act in 2020.

Changes for 2019 Reporting

There have been some slight changes made to the 1095 and 1094 forms. Hence, Kim Bucky, the vice president of client services at DirectPath, instructs employers should double-check and make sure that they have the latest versions.

The forms now highlight how Congress removed the penalty for taxpayers (those who do not have ACA-compliant health coverage). The penalty is now $0. Now no individual coverage is needed. This was once known as the ‘individual responsibility requirement.’ The IRS reported that people do not have to inform whether they had coverage during federal income tax filing.

ACA Reporter also came to know that the new instructions remind participants who were offered minimum essential coverage through their employers will not meet the premium tax credit applicant criteria. They will also not be eligible for a subsidy while buying insurance coverage, according to Buckey.

"These changes will require updates to any templates employers might be using," she said.

A new type of health reimbursement account (HRA) has also been introduced this time. Moreover, there is a new page added, which means that applicants might have to modify their reporting systems.

Small business Health care tax forms, interestingly, were updated as well. Form 8942 by the IRS was issued for small businesses, especially. The form is for small business limited to less than 25 employees.

The Final forms and instructions according to IRS website:

- Form 1095-B, Health Coverage.

- Transmittal Form 1094-B to accompany Form 1095-B.

- Instructions for Forms 1094-B and 1095-B.

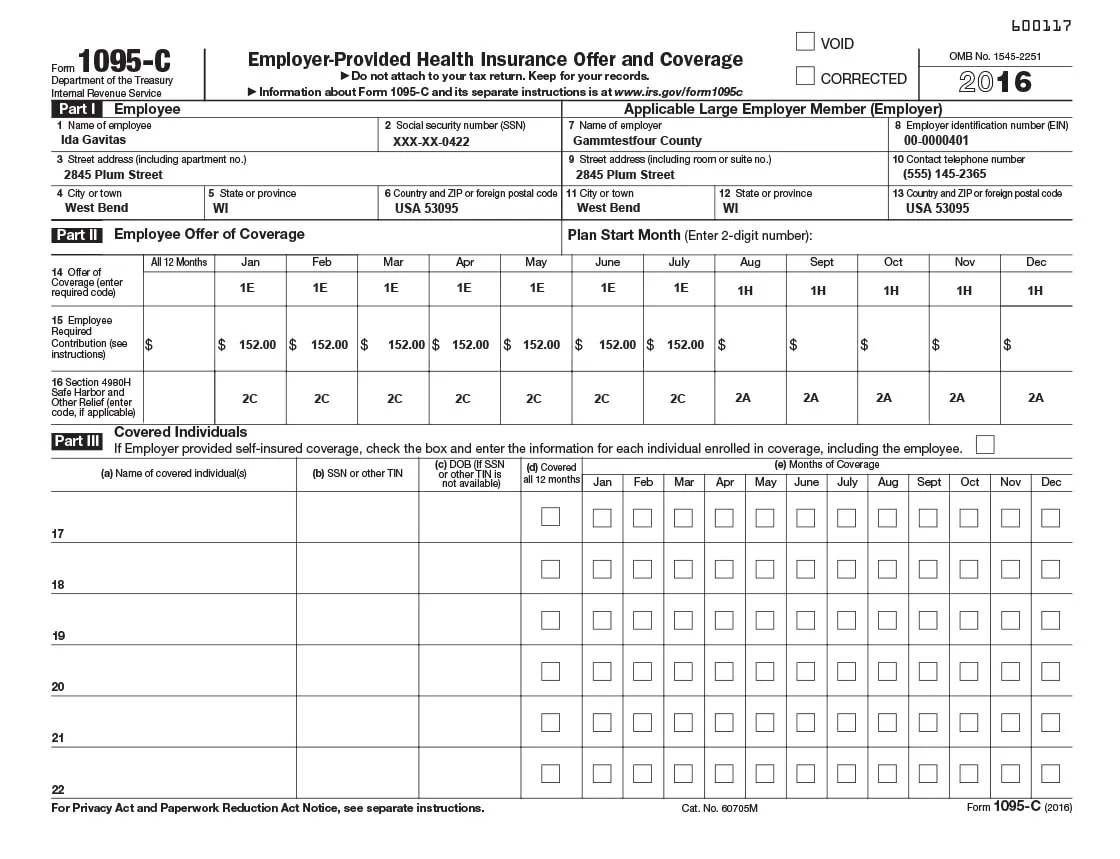

- Form 1095-C, Employer-Provided Health Insurance Offer, and Coverage.

- Transmittal Form 1094-C to accompany Form 1095-C.

- Instructions for Forms 1094-C and 1095-C.

The IRS Publication 5223 explains how employers can prepare substitute forms to provide the required ACA reporting information to IRS and employees.

Requirements for ALEs

Those ALE’s which have more than 50 employees hired on full-time basis last year will have to use the 1095 C form to show that they have given their employees the minimum essential coverage and the minimum value threshold too. These requirements are needed whether am ALE gave coverage via a group health plan or funded ICHRAs through which employees made coverage purchases for their selves and families from ACA marketplace exchanges.

| ACA Requirement | Deadline |

|---|---|

| 1095 forms delivered to employees | January 31 |

| Paper filing with IRS | February 28 |

| Electronic filing with IRS | March 31 |

The IRS has not yet announced whether the delivery deadlines. There are possible chances that the deadline for providing forms of 1095 C to employees will be extended due to the pandemic. If it does happen, employers can choose to distribute the forms along with the employees W-2 earning statements.

Compliance firm Hub international, however, states that the IRS will not grant 30-day extension beyond the given deadlines. If an employer submits an extension request, the IRS will not respond. The IRS, thus, advises employers to furnish the forms to employees as soon as possible to avoid penalties.

ICHRA

ICHRA lets employers set aside a dollar amount yearly for each full-time employee without any taxes added. It was created under the IRS regulations statements. ALE’s must fund these amounts to employees.

New Codes

Eight new codes were added in the revised draft. These codes are there for the employers to state their methods they used to check their affordability for ICHRA plan.

"The added codes to Form 1095-C can help employees understand how their employer determined ICHRA affordability," says Josh Miner (PeopleKeep’s senior product manager).

An HR services firm from ADP further stated that these contributions made by eligible employers must be high enough to enable employees to easily buy the lowest cost silver plans offered to ensure that not more than 9.5% of employees’ incomes are used to buy such plans.

Changes for 2019 Reporting

Ryan Moulder, a LA-based partner at Health Care Attorneys PC says that as the changes in the draft may alarm employers at first glance, most employers will not be impacted much in reality. This put some confused employers at ease who felt uncomfortable with modifying their reporting systems.

Then again, advisors at MZQ Consulting in Pikesville; blogged that these changes demand altering to the existing employer reporting systems. They also highlighted that printing costs will now increase due to the adding of new pages.

Interestingly, the consultancy mentioned how they used the IRS form comment page to leave a request to the IRS to squeeze the content onto one page again. They even suggested other who didn’t like the extra page to leave the same request. Will they accept the request is a whole separate story.

"Even though we don't know too many ALEs that went with the ICHRA option, we're going out on a limb and predicting that those who did are going to find the new codes a bit baffling,"

It is expected that further instructions and clarity regarding the forms will be released by the IRS in the upcoming weeks.

Many companies rely on ACAreporter for their reporting needs. If you need any assistance in ACA reporting. Contact us!